Should you rent or buy? This is often not a simple question. There are pros and cons to renting a place, just as there are pros and cons to owning a home. One of the biggest cons to renting is the close proximity to neighbors and the biggest pro is the maintenance of the home is the responsibility of your landlord.

Should you rent or buy? This is often not a simple question. There are pros and cons to renting a place, just as there are pros and cons to owning a home. One of the biggest cons to renting is the close proximity to neighbors and the biggest pro is the maintenance of the home is the responsibility of your landlord.

There’s no question that buying a house makes sense for some folks. Owning a home gives you stability (you’re not at the mercy of a landlord) and freedom (you can do what you want with the place). Many Americans see buying a home as an essential step in a successful life, and owning one can bring significant financial benefits. The most obvious upside is that a home can significantly increase in value. The median sales price of existing single-family homes rose 81% from 1993 through 2013, according to the National Association of Realtors. In fact the median house price for Marinette County according to the Wisconsin Association of Realtors rose 46% to $119,900 in January, 2015 compared to $82,000 for the same period in 2014.

Renting had typically been less expensive than buying on average across our area. But all that changed during the financial crisis due to a few major issues. First, after the subprime mortgage crisis home prices declined and it became more difficult for borrowers to refinance their loans. As adjustable-rate mortgages began to reset at higher interest rates (causing higher monthly payments), mortgage delinquencies soared and people lost their homes and now need to rent. Secondly, interest rates on mortgages dropped significantly. Rates have hovered near record lows for quite some time making home ownership more affordable. Lastly, due to the recent influx of people coming into the area to work for Marinette Marine and Anchor Coupling rental prices have sky rocketed within the last couple of years. A typical 3 Bedroom, 1 Bath home that used to rent for $500 per month now rents for $750 per month or more.

There are some critical questions that need to be answered to determine which will be best for you:

- How Long Do You Plan to Stay?

Buying tends to be better the longer you stay because the upfront fees are spread out over many years. However, if you are not settled into your career or could have an opportunity to relocate in the near future, it is much easier to switch to a month-to-month lease or sublet than it is to sell your home.

- What Is the Cost of Buying?

In addition to the interest rate and down payment, you need to take into account the mortgage-interest and property tax deduction. You should also take into consideration how much you want to spend on your housing and whether you are ready to make the long-term commitment.

Do You Have the Ability to Finance a Home Purchase?

If you’re considering buying a home, your first step should be to meet with a lender to determine whether you qualify for a mortgage and, if so, how much you can borrow. Your ability to qualify depends on several major factors: Credit Score, Income, Debt to Income Ratio and assets. If you fall short on any of these, you may be better off renting until you can improve your credit score and save more money.

Buying a home is a major decision that shouldn’t be taken lightly, but when faced with rising rent and low mortgage interest rates that make purchasing more affordable, you should take the time to consider the pros and cons of both renting and buying. As long as you can comfortably afford your housing payments and are emotionally prepared to commit to homeownership, buying a home can be a smart financial move.

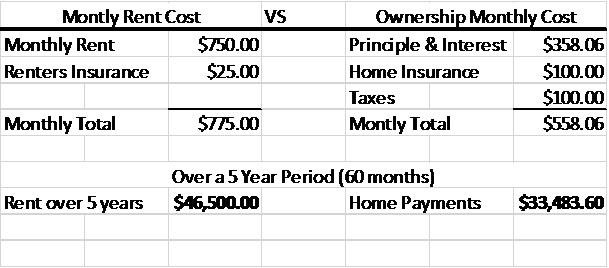

Compare Costs – Rent – $750/Month vs a $75,000 Home Purchase @4.5% interest amortized over 30 years.